PEST CONTROL – A RISKY BUSINESS: WHAT YOU NEED TO DO TO PROTECT YOURSELF

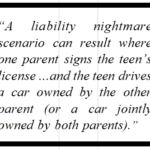

By: Howard Rosen, Attorney, © 2021 Donlevy-Rosen & Rosen, P.A. Direct line: 305-459-3289 Anyone in the pest control business (PCB) is aware of the risks and controversies involved in that business. Most commonly, there is always the everyday risk of an employee getting into a serious automobile accident with a company vehicle, particularly since companies […]

Connect

Connect with us on the following social media platforms.